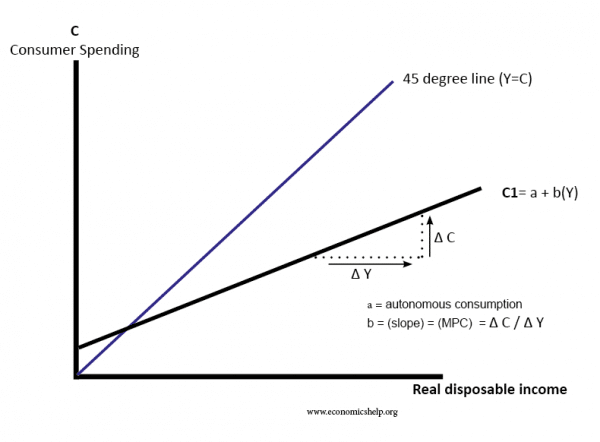

The Keynesian consumption function expresses the level of consumer spending depending on three factors.

Consumption function formula

This suggests consumption is primarily determined by the level of disposable income (Yd). Higher Yd leads to higher consumer spending.

This model suggests that as income rises, consumer spending will rise. However, spending will increase at a lower rate than income.

If you cut income tax for those on low income, they tend to have a higher marginal propensity to consume this extra income. Therefore, there is a large increase in spending. People with high incomes will tend to have a lower marginal propensity to consume. If they benefit from a tax cut, they will save a greater proportion.

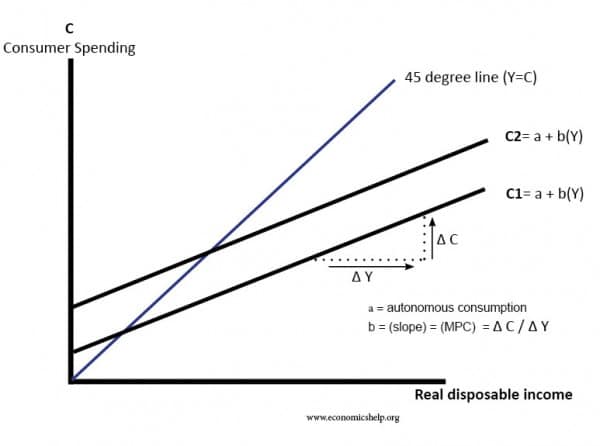

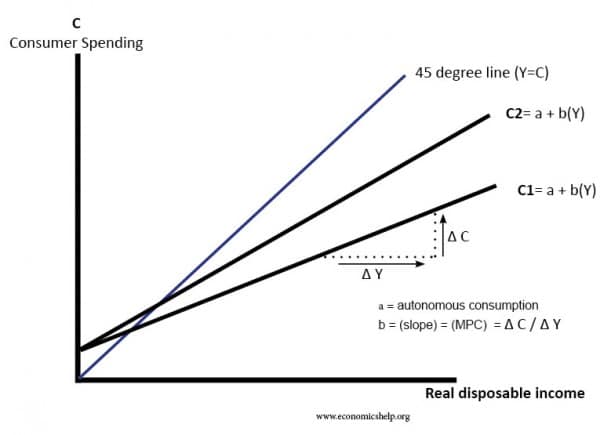

In this diagram, the consumption function has shifted to the upwards (to the left. (C1 to C2). This means consumers are spending a higher % of their income. This could be due to a rise in property prices which increases consumer confidence and lead to higher consumer spending.

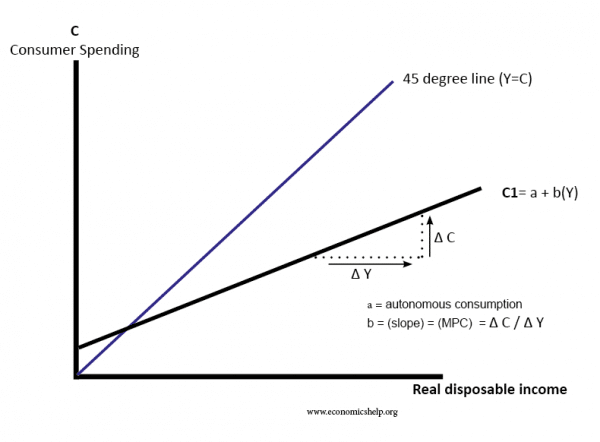

In this diagram, the consumption function has become steeper. This means the value of b (MPC) has increased. Therefore, people are spending a higher % of their additional income. This could be due to rising confidence, lower saving and easier availability of credit.

In the real world, people are influenced by other factors

Consumption is primarily determined by levels of income but also other factors such as:

Permanent income hypothesis (Milton Friedman) This is a theory that a person’s consumption is determined, not just by current income, but also future expected income. It suggests that consumers will attempt to ‘smooth consumption’ over their lifetime, e.g. borrowing as a student, running down savings in retirement.

Life-cycle hypothesis (Richard Brumberg & Franco Modigliani). Another theory that people attempt to smooth consumption over their lifecycle. This suggests that spending will be dependent on current income, future expected income and also a function of wealth. See: Life-cycle hypothesis

Related