We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional.

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

All reviews are prepared by our staff. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication.

Written by

James Royal, Ph.D.

Bankrate principal writer and editor James F. Royal, Ph.D., covers investing and wealth management. His work has been cited by CNBC, the Washington Post, The New York Times and more.

Edited by

Brian Beers

Brian Beers is the managing editor for the Wealth team at Bankrate. He oversees editorial coverage of banking, investing, the economy and all things money.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money .

Bankrate logoFounded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our investing reporters and editors focus on the points consumers care about most — how to get started, the best brokers, types of investment accounts, how to choose investments and more — so you can feel confident when investing your money.

Investing disclosure:

The investment information provided in this table is for informational and general educational purposes only and should not be construed as investment or financial advice. Bankrate does not offer advisory or brokerage services, nor does it provide individualized recommendations or personalized investment advice. Investment decisions should be based on an evaluation of your own personal financial situation, needs, risk tolerance and investment objectives. Investing involves risk including the potential loss of principal.

Bankrate logoBankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

Bankrate logoYou have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

So you’ve realized a profit on your investments? Buckle up and get ready to report your transactions to the Internal Revenue Service (IRS) on Schedule D and see how much tax you owe.

But it’s not all bad news. If you lost money, this form helps you use those losses to offset any gains or a portion of your ordinary income, reducing the taxes you owe. And if you profited from your transactions, Schedule D helps ensure you don’t overpay Uncle Sam for your gains.

Schedule D is an IRS tax form that reports your realized gains and losses from capital assets, that is, investments and other business interests. It includes relevant information such as the total purchase price of assets, the total price those assets were sold for and whether those assets were held for the long term (more than a year) or short term (less than a year).

You’ll have to file a Schedule D form if you realized any capital gains or losses from your investments in taxable accounts. That is, if you sold an asset in a taxable account, you’ll need to file. Investments include stocks, ETFs, mutual funds, bonds, options, real estate, futures, cryptocurrency and more. Those who have capital losses that they’re carrying over from previous tax years will want to file Schedule D so that they can take advantage of the tax benefit.

Others will need to file Schedule D as well. Those who have realized capital gains or losses from a partnership, estate, trust or S corporation will need to report those to the IRS on this form. Those with gains or losses not reported on another form can report them on Schedule D, as can filers with nonbusiness bad debts. Those with like-kind exchanges and installment sales may need to answer questions about their transactions on Schedule D.

The two-page Schedule D, with all its sections, columns and special computations, looks daunting and it certainly can be.

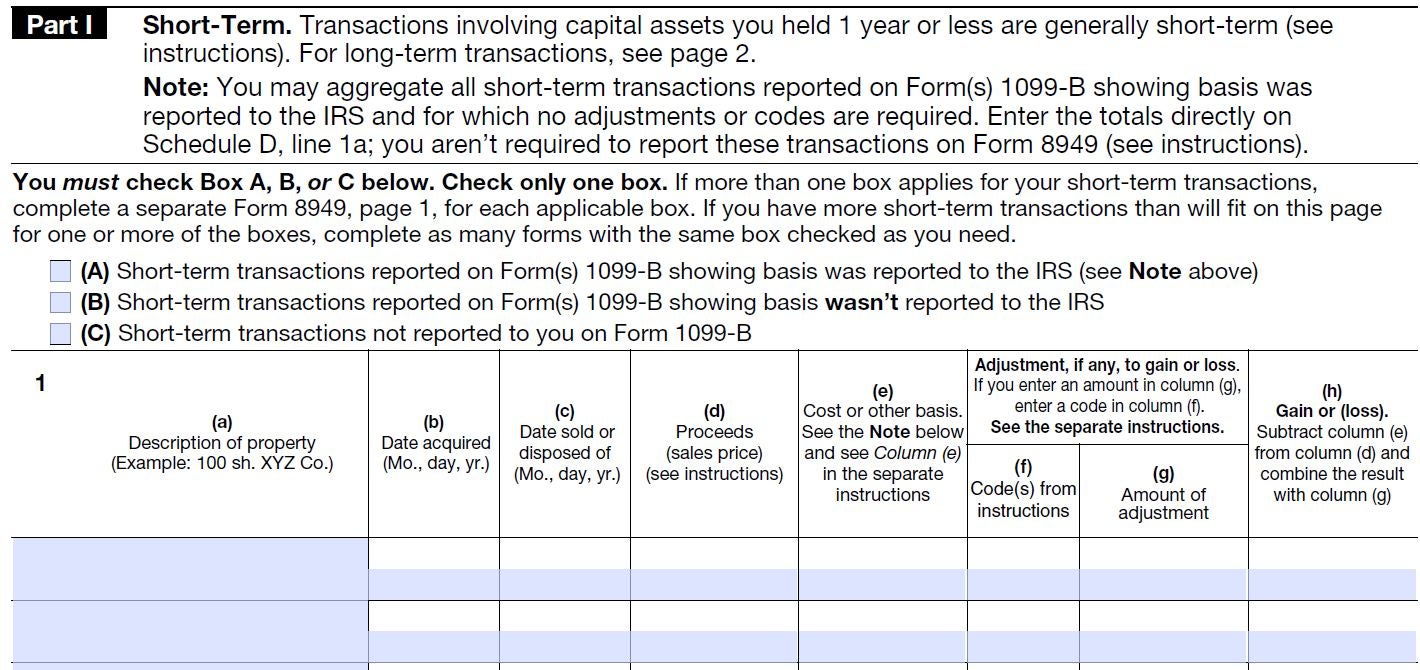

To start you must report any transactions first on Form 8949 and then transfer the info to Schedule D. On Form 8949 you’ll note when you bought the asset and when you sold it, as well as what it cost and what you sold it for. Your purchase and sales dates are critical because how long you hold the property determines its tax rate.

If you owned the asset for a year or less, any gain would typically cost you more in taxes. These short-term sales are taxed at the same rate as your regular income, which could be as high as 37 percent on your 2023 tax return. Short-term sales are reported in Part 1 of the form.

However, if you held the property for more than a year, it’s considered a long-term asset and is eligible for a lower capital gains tax rate — 0 percent, 15 percent or 20 percent, depending upon your income level. Sales of long-term assets are reported in Part 2 of the form, which looks nearly identical to Part 1 above.

Once you determine whether your gain or loss is short-term or long-term, it’s time to enter the transaction specifics in the appropriate section of Form 8949. All transactions require the same information, entered in either Part 1 (short term) or Part 2 (long term), in the appropriate alphabetically designated column. For most transactions, you’ll complete:

(a) The name or description of the asset you sold

(b) When you acquired it

(c) When you sold it

(d) What price you sold it for

(e) The asset’s cost or other basis

(h) The gain or loss

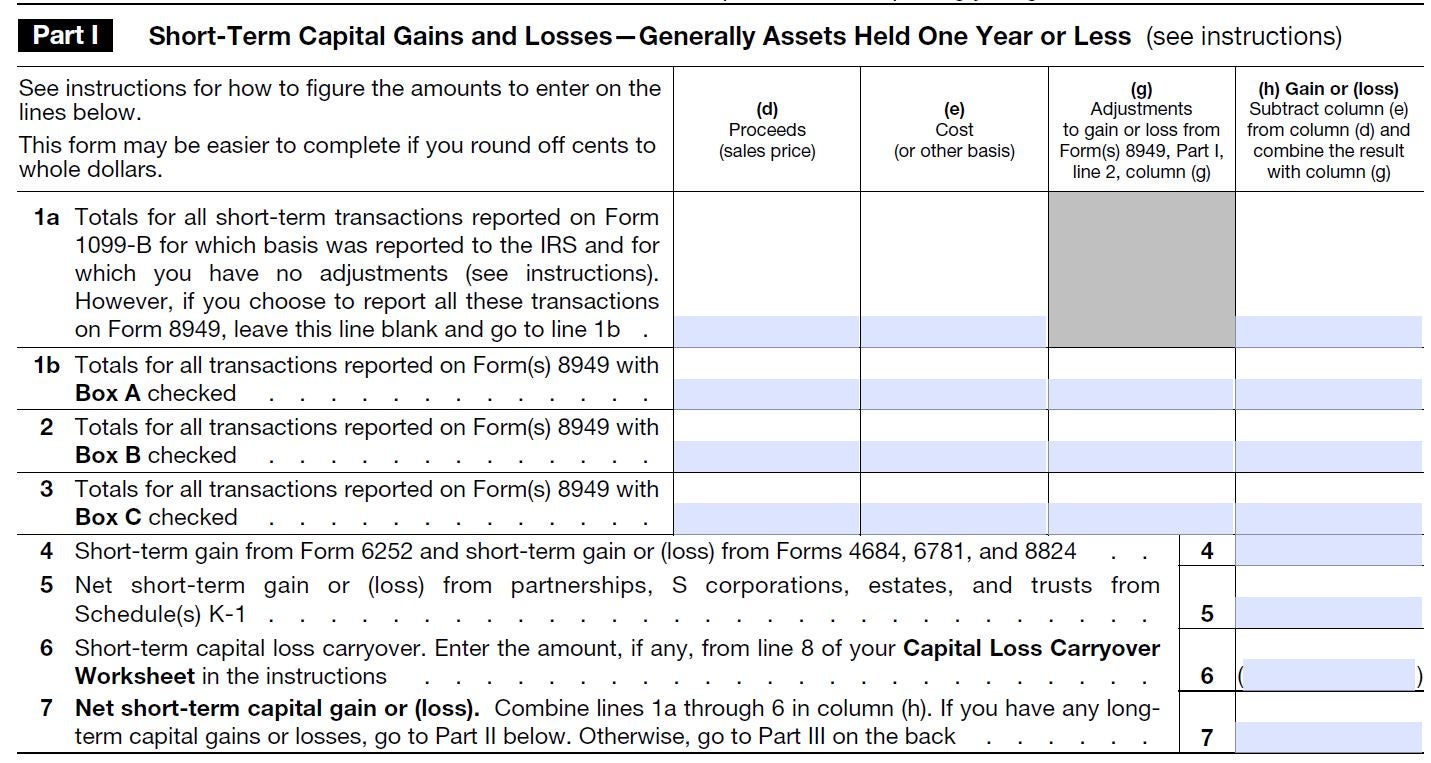

Total your entries on Form 8949 and then transfer the information to the appropriate short-term or long-term sections of Schedule D. On that tax schedule you’ll subtract your basis from the sales price to arrive at your total capital gain or loss, as in the sample below.

Schedule D also asks for information on some specific transactions that do not apply to all taxpayers, such as installment sales, like-kind exchanges, commodity straddles, sales of business property and gains or losses reported to you on Schedule K-1.

Check out the complete list and if any of these apply to your tax situation, it probably would be wise to turn Schedule D and the rest of your tax paperwork over to a professional. These are complicated matters, and it can be easy to make a mistake even with the best intentions.

Schedule D also requires information on any capital loss carry-over you have from earlier tax years on line 14, as well as the amount of capital gains distributions you earned on your investments.

You may be able to avoid filing Schedule D, if one of the two situations below applies to your return:

Once you’ve filled in all the short-term and long-term transaction information in Parts 1 and 2, it’s time to turn over Schedule D and combine your asset-sale details in Part 3. This section essentially consolidates the work you did earlier, but it’s not as easy as simply transferring numbers from the front of the schedule to the back.

Lines 16 through 22 direct you to other lines and forms depending on whether your calculations result in an overall gain or loss. A couple of lines in Part 3 also deal with special rates for collectibles and depreciated real estate. Again, in these situations, expert tax advice might be warranted.

Use Schedule D to total up your gains and losses. If you total up a net capital loss, it’s not good investing news, but it is good tax news. Your loss can offset your regular income, reducing the taxes you owe – up to a net $3,000 loss limit.

If you reported a net loss greater than the annual limit, it can be carried forward to use against gains in future tax years until it’s exhausted.

As a bonus, your capital loss means you’re through with Schedule D. You simply transfer your loss amount to your 1040 and continue your filing work there.

When you come up with a gain, the tax paperwork continues. And this is where the math really begins, especially if you’re doing your taxes by hand instead of using software.

Depending on your answers to the various Schedule D questions, you’re directed to the separate Qualified Dividends and Capital Gain Tax worksheet or the Schedule D Tax worksheet, which are found in the Form 1040 instructions booklet. These worksheets take you through calculations of your various types of income and figure the appropriate taxation level for each.

Before you begin either of these worksheets, be sure you’ve completed your Form 1040 through line 11 (that’s your taxable income amount), because that’s the starting point of both worksheets. From there you’ll have lots of addition, subtraction, multiplication and transferring of numbers from various forms.

But if you sold stock or other property, don’t be tempted to ignore Form 8949, Schedule D, the associated tax worksheets and all the extra calculations. Remember, the IRS received a copy of any tax statement your broker sent you, so the agency is expecting you to detail the sale, and gain or loss, with your tax filing.

The extra work needed in figuring your capital gains taxes is generally to your advantage. Regular income tax rates can be more than twice what’s levied on some long-term capital gains. So when you’re finally through with the calculations, your tax bill should be lower than it would have been if you had simply used the standard tax table to find your tax due.

Note: Kay Bell contributed to a previous version of this story.

Arrow Right Principal writer, investing and wealth management

Bankrate principal writer and editor James F. Royal, Ph.D., covers investing and wealth management. His work has been cited by CNBC, the Washington Post, The New York Times and more.